New School, New Students, New Grades Levels.

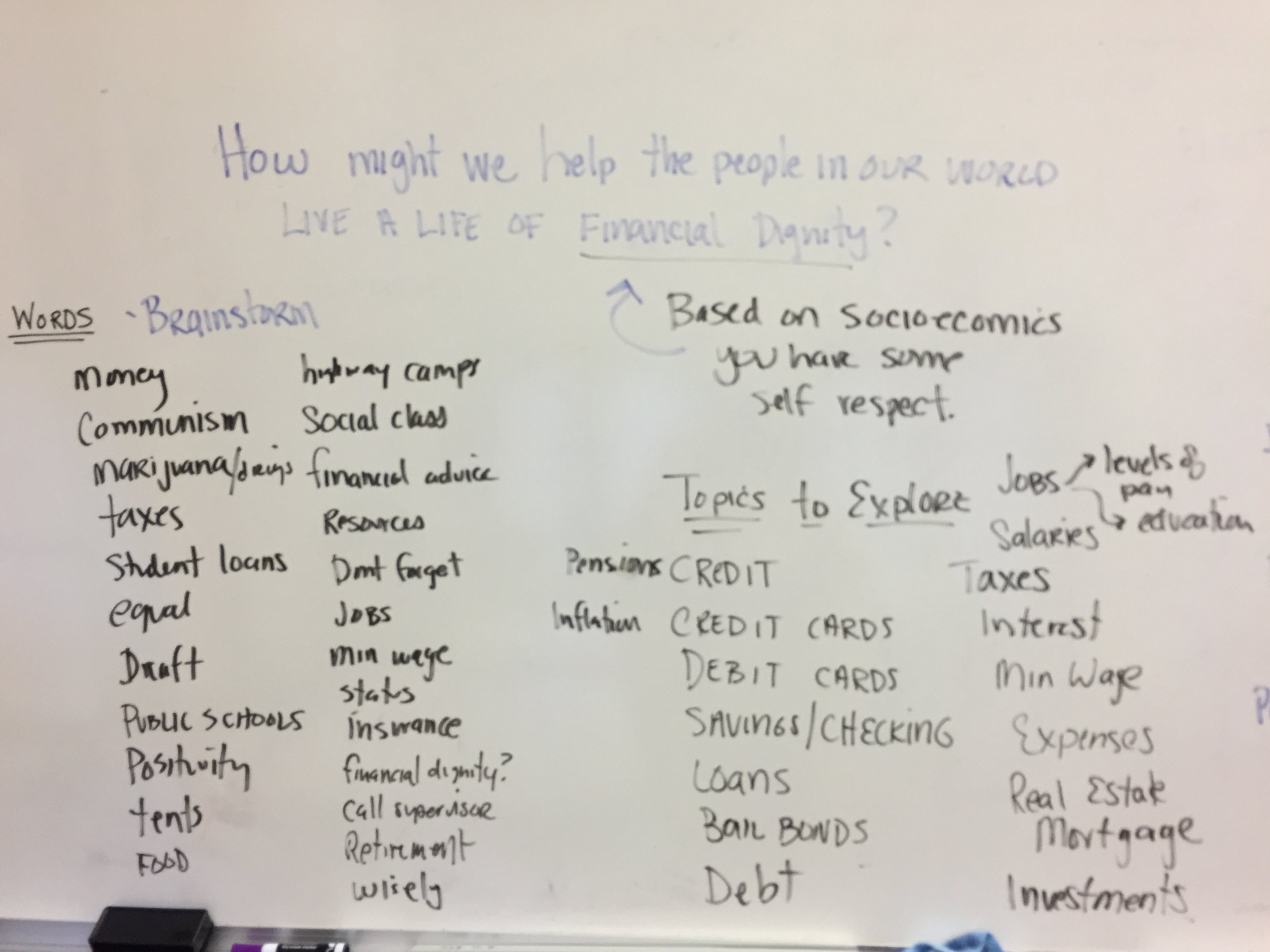

New Driving Question: How might we help the people in our world live a life of financial dignity?

Having worked through "It's a Livable Life" for years, I was determined to make that 5th/6th grade project work in the 7th grade curriculum in some form, adapt it and make it 7th grade "rich". After much thought I refocussed the driving question to challenge the boys to learn financial literacy skills simultaneously to learning what it might mean to have a dignified life in that regard.

I started the project like in years past by having the boys participate in the Amenities Challenge. The boys began to understand that adults sometimes need to make complicated decisions about finances and not everyone has disposable income. We spent grandparents/special friends day interviewing our guests to learn more about what goes into a monthly budget and asking them what challenges they have experienced along their adult journeys.

The entry events went well and when I floated the driving question to them I immediately got excited. I gave the boys 5 minutes to brainstorm with a friend. This was an opportunity to mind map, ask questions, wonder and think. As a group we began by listing words that came to mind that we felt connected to the question and then we listed topics we might explore in order to gain background information to answer the question. As I explained to the boys, this question is BIG and can have a range of answers from 2nd grade thoughts to pHd level projects in economics and public policy. From their ideas I began to think about what we could investigate mathematically at a 7th grade level so that we could help create some background that gets them thinking.

Minimum Wage? The boys had listed the topic and it would give us some background. Does living on minimum wage allow you to live a life of dignity? Utilizing the worksheets I have used before, I added to them by exploring taxes too. We looked at tax brackets, deductions, gross income, expenses and net pay. The boys were discovering quick that this wasn't cutting it! They explored this concept utilizing national averages and then transferred that information and utilized cost of living to explore our own city of San Francisco and another location in the US.

Through minimum wage conversations issues of education, healthcare, gender and other topics came up. So I utilized it as an opportunity to teach ratios and proportions and talk about salary differences, ratios and proportions. This was difficult. While are still in the midst of this conversation I was initially shocked at how my students were talking about gender. Being the only female in the room was difficult as I dove into male privilege and cultural messages of gender and it was hard not to get pretty heated as they got defensive. I had to remember they are only 12/13 and need to have these lessons so they can learn. Baby steps.

Now we are on to the next set of lessons... credit, debit, banking, simple interest vs compound interest. All of this packaged together an ending with a Kiva Loans as one possible way to help enable those in our world who might need to catch that break that will change their lives. I am hoping the boys learn that a people need a hand up not a handout and we can empower them. Time will tell. And I will then see where they want to go from there. See you soon.